On November 29, 2023, the Bureau of Economic Analysis (BEA) released the Gross Domestic Product (GDP) figures for the third quarter of the year, and the report painted an encouraging picture of a resilient and thriving economy. The Q3 2023 GDP figures showcased a quarterly increase of 5.2% compared to Q2 2023, demonstrating the nation’s capacity for growth even in the face of challenges.

Impressive Economic Growth

The Q3 2023 GDP report revealed a 5.2% quarterly growth rate, surpassing expectations and marking a significant rebound from earlier in the year. This robust expansion can be attributed to several key factors:

- Consumer Spending Surge: Consumers continued to drive economic growth, with robust spending on goods and services. Although the figures were revised lower from the advanced GDP release, from a 4.0% increase to a 3.6% increase, low unemployment rates, increased wages, and pent-up demand contributed to this consumer confidence.

- Nonresidential Fixed Investment: This segment increased 1.3%, which is a sharp departure from the 7.7% growth seen in Q2 2023. The business confidence index was at 98.7 (Above 100 means confidence is growing and below means that it is decreasing). Despite the index being below 100 the expansion has continued mildly.

- Government Spending: Government spending on infrastructure projects and social programs further boosted economic growth. A blazing 5.5% increase in Q3 adds a lot of padding to those GDP figures.

Challenges on the Horizon

Despite the impressive growth figures, the Q3 GDP report also underscored some challenges that the economy faces:

- Inflation Concerns: Inflation rates remained elevated, eroding some of the gains in real income. At last measure inflation was down considerably, but was still clocking in at 3.24% as of October 2023. The Fed has a target of 2% and Powell seems to be sticking to his guns about getting to that target.

- Government Spending: The government punchbowl has been a significant support for the US economy for generations. US government spending makes up about a quarter of GDP; however, the deficits are starting to add up. In FY 2023 the federal deficit was $1.7 trillion and the CBO estimates it will be $2.0 trillion in 2024. With the current national debt at $33.8 trillion and the 10 year treasury at 4.4% the interest expense will become a serious burden. It appears there will be a reckoning at some point.

- The Consumer: The US consumer is the unapologetic world champion of spending, but how long can they keep it up? The jobs figures and real wage growth are encouraging; however, according to Deloitte 45% of US respondents felt anxious about their finances in October, which was up by 13% from July. Also, total household debt reached a record $17.3 trillion in Q3 2023.

Economic Indicators

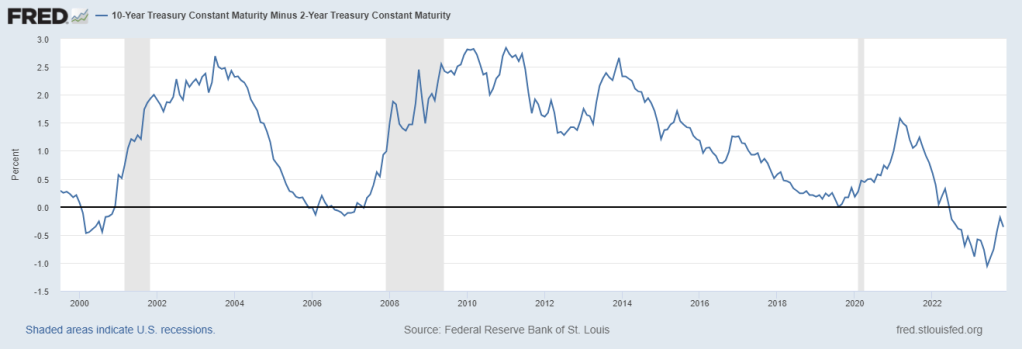

There are a number of economic indicators that we can look at that can help us make decisions about the future – well known ones like a yield curve inversion and even less well known indicators like the Sahm Rule.

- Yield Curve Inversion: This is a popular chart because it has been effective at predicting recessions. An inversion occurs when short dated treasuries have higher yields than longer term treasuries. Below is the 10 year minus the 2 year and you’ll notice that an inversion has occurred before the last 3 recessions; however, the current 10-2 inversion has been in place since July of 2022 and GDP figures are strong. Maybe we dodged a bullet on this one? After all the level of stimulus put into the economy from 2020-2022 is unprecedented.

- Sahm Rule: The Sahm rule measures the change in the employment rate. The signal occurs when the three-month moving average of the national unemployment rate rises by 0.50% or more relative to the averages from the previous 12 months. In March 2001 the indicator was at 0.30% and in December 2007 the indicator was at 0.40% when the US entered a recession. The US is currently at 0.33% so we’re right where prior recessions began. One caveat, in June and August of 2003 the indicator reached 0.47%, but a recession did not occur.

Take Away

It appears that the US economy is performing well. I think the stock market will cheer any indications of rates cuts and beat the soft landing drum, leading to new market highs over the next 3 months; however, caution is in order because a deterioration of employment, a change in consumer spending, less capitulation by the Fed on rates, or a new military conflict could derail things rapidly.