The tenor of the previous Federal Reserve meeting set the stage for a potential pause in interest rate increases. After 10 consecutive increases, the market seemed pretty pleased with many even believing that a cut might happen before year end. However, recent comments from Fed Governor Philips make a pause seem less likely and a cut by year end even less likely.

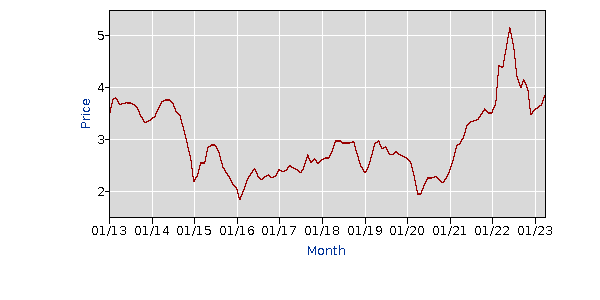

Governor Philips said little progress has been made with the inflation of services, which is a metric that Fed Chair Powell pays close attention to. Although headline inflation in March was down to 4.20% that vast majority of the decline was attributed to energy and food costs, which are volatile and exclude from core inflation. According to data from the US Bureau of Labor Statistics, it should be noted that gasoline prices appear to be increasing after peaking in June of 2022 at $5.15/gallon and bottoming out at $3.46/gallon in December of 2022. As of the end of April 2023 the average price of gasoline was $3.84/gallon, up10.9% from December. The tailwinds of energy reducing inflation might be turning into headwinds.

Average Price of Gasoline, all types, per gallon/3.785 liters

With a debt ceiling deal seemingly agreed to and the impact of the recent bank failures beginning to wane, the probability of a 0.25% increase at the next meeting of the FOMC on June 14th has moved from 28.1% 7 days ago to 64.2% as of today, according to the CME Group FedWatch Tool.

The implications of another increase would continue to put pressure on cap rates of commercial real estate and the probability of problem loans increasing with loans that are repricing in the next 12 to 24 months.